Hi, Web3 buddies 👋

This is the Epic Web3 Newsletter — a weekly dose of best practices & insights from the top industry experts to help you dive into Web3 and boost Web3 products.

In this week’s deep-dive, we’re gonna to:

Invite you to a CustDev call for Web3 builders;

Learn what financial challenges DAOs face nowadays & how to plan an effective growth strategy for them;

Share the juiciest deals and news from the Web3 world.

🎉 We’re inviting you to a CustDev call

Hey, this is Olly, the Epic Web3 co-founder, speaking 👋

I’m here to find Web3 builders open for a CustDev call :)

Our team's digging deeper into Web3 and we're about to launch Epic Web3 Club. It’s a case-based education platform for Web3 builders.

To make this product valuable for you, I'd love to get some feedback from you.

So if you're open to have a short call and share your experience & expertise in the Web3 space – please find 30 min to chat with me. Feel free to schedule a call via this link:

P.S. Everyone we have a call with will get a 1-month subscription to GrowthDAO as a gift 🙂

🧑💻 It all starts with your treasury. Community Insights on how to plan your DAO growth strategy.

DAOs are more than on-chain smart contract codes sitting on the blockchain network. These are emerging global coordination mechanisms leveraging a variety of tools and governed mutually by the community based on equal voting rights and tokenized incentive frameworks.

To run a successful DAO, it’s crucial to understand the challenges DAOs are facing today that could hurt their long term growth and in some cases their very existence.

We asked Rohit aka degenrsc (Growth Lead at Mesha) to share insights on how bad financial management could derail the growth agenda for DAOs and Web3 projects.

— First of all, what is the community treasury everyone speaks about?

The community treasury is the heart of every DAO. Given they’re living on-chain, DAOs are de facto more transparent in their financial activities. Yet, for a community member to get a summary of the treasury’s activities over the past month is a heavy duty task needing him to spend hours digging through Etherscan, Snapshot, and Discourse.

A crypto community treasury consists of crypto assets in a wallet owned and operated by the community. It is like a community savings account with assets in crypto (not fiat), typically held in a multisig wallet (not a bank account), managed by the community (not a CFO/CEO), and public (not private).

DAO treasuries now account for $10 billion in crypto assets, and have added $1.2 billion in the past year alone. This hyper growth is driving many to this space, and leverage an open and permissionless community to supercharge innovation, collaboration and growth.

— How has the current Bear market exposed weaknesses in DAOs?

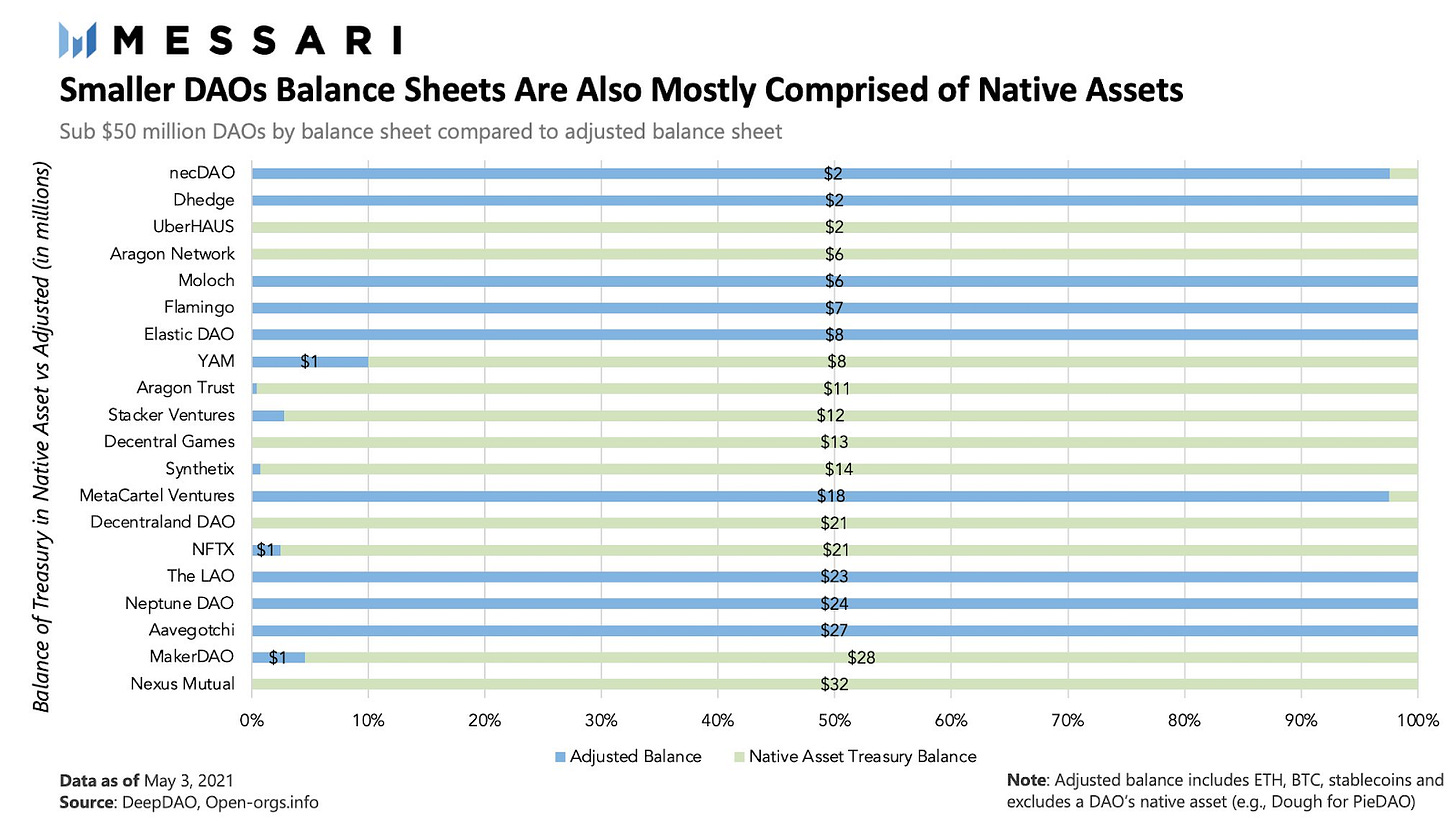

Most DAO treasuries hold their native governance token as the primary asset driving economic incentives and value accruals for the community.

Partnerships are at the heart of seeding your dApp, NFT collection or any other Web3 centric project you’re building. This means leveraging your DAO’s governance token for token swaps with the aim of onboarding strategic partners to drive value accruals across the base.

Diversifying for sustainable growth is critical for any web3 project. If you’ve raised capital either through a community launch, an NFT sale or through VC’s there’s a need for you to protect and sustain that capital to invest in your project’s core capabilities like manpower, technology, marketing channels and more.

The key challenge for most DAOs is to safeguard their capital from the wild swings in the crypto market. As of June 2022, DAOs collectively lost 50% of their treasuries owing to the market crash, in other words these projects got 50% of their balance sheets wiped-off creating growth bottlenecks and massive unrealized or realized losses.

— What is a solid financial strategy to DAO growth?

A well-planned financial strategy for DAOs and Web3 startups revolves around a clear objective. Growth needs to be funded, and planning in advance makes a huge difference.

To give you more food for thought, here’s a great list compiled by Treasury experts Llama on the key open problems to solve with crypto treasuries:

How can a treasurer easily categorize transactions and produce a summary statement?

How can community members quickly find details for a specific payment made five months back?

How can they see a summary of the treasury’s activities for a particular historical month?

How can they filter all the bounties made since the treasury’s inception?

How can they see the average salary paid to community managers across all crypto projects?

For VC funded projects like Uniswap, how do we integrate off-chain expenses made in VC-funded dollars with on-chain income?

How do we produce real-time income statements, cash flow statements, and balance sheets that can be accessed by community members, contributors, investors, and outsiders?

How can we standardize these statements across crypto projects, similar to the standardization of statements in 10k reports of public companies?

How can we rate the financial health of a treasury?

For DAOs or other projects that are registered as legal entities, how do we produce statements that can easily be used by accountants and tax people?

As you can imagine, all of these questions aren’t simple to answer. It also begs the need for a stable and trusted financial platform that can replace your spreadsheets/diaries with cutting edge digital dashboards automating your on-chain finances and helping your track/trace results in real-time.

— What tools to use to empower DAOs financially?

DAO Tools are an evolving segment of products built for Web3 and DAOs looking for native solutions. There are many aspects to financial management - from accounting to compliance, and bookkeeping to asset allocation, there’s a ginormous set of overlapping and sometimes independent processes and systems needed to manage these sub-segments of finance.

Treasury management tools like Mesha, Request, Juicebox and Safe (Earlier Gnosis) are working to build solutions that can help DAOs and Web3 startups to easily optimize their finances - this includes treasury diversification, fund raising, investing, managing payroll, tracking incomes and expenses, and generating timely reports to evaluate business performance metrics.

Mesha is building a suite of financial products for DAOs and other crypto native organizations. Access corporate cards, treasury management and easy payments with our all-in-one financial suite built on top of Gnosis. If you’d like to learn more about Mesha and how we can help simplify your financial management, dive in here, or get started now — it’s completely free.

P.S. To learn more about the latest developments in DAO, NFT & crypto, subscribe to The Mesha Tribe newsletter:

Web3 is a fast-changing industry, that’s why we can’t leave you without up-to-date news. Here are the juiciest ones to share this week:

1/ VC fund Variant raises $450M, doubles down on Web3 amid ‘crypto winter’. Led by a16z veterans Li Jin, Jesse Walden, and Spencer Noon, the venture emphasizes investments in users-owned networks that could create favorable economic terms.

2/ Web3 digital identity startup Unstoppable Domains raises funds at $1B valuation. A popular blockchain naming system provider and identity platform is the latest crypto startup to become a unicorn.

3/ Solana opens its first real-world store. At the store located in New York City you can learn how Solana works, get your first wallet set up, buy your first NFT, make your first crypto transactions. How do you like that?

That’s it for today! Hope you found this week’s dose insightful 👋

If you want to get valuable insights daily, subscribe to our Telegram channel:

Talk soon,

The Epic Web3 team