🧞How to solve fragmentation - Everclear case study

Solving fragmentation problem with the clearing

Gm and happy Monday frens🖖

Fragmentation is one of the biggest problems in Web3 and it is growing every day - at the beginning of the year L2beat had 34 active projects and 33 upcoming projects. Currently it has 74 L2s, 22 L3s and 81 upcoming projects. Damn.

It stagnates adoption, provides a poor user experience and wastes resources. In short, it makes everyone's life harder than it has to be.

Chain abstraction is supposed to change that, but there are still problems to solve.

What are they?

Scroll down and learn:

🌏 TOKEN2049 IS NEXT WEEK

🧹 It's time to clear

📰 Neeews

🍹 First-ever blended execution network

Fluent is the first blended execution network, integrating Wasm, EVM, and soon SVM smart contracts into a unified Ethereum L2 environment. Build real-time, composable dApps across multiple VMs without friction.

Ready to shape the future?

💠 Modular & L2 Day (co-organized by TAC & Nubit)

If you're into modular design, modular blockchain stacks, and layer 2 scaling solutions.

Here are some great keynotes that you can catch:

Chain Abstraction and the Ripples in the Matrix by Mayur Relekar, Founder & CEO @ Arcana

Enabling 1 Billion Users to the EVM World by Pavel Altukhov, Founder & CEO @ TAC

How to Onboard the Next Million Consumer Apps by Prof. Yu Feng, Founder & CEO @ Nubit

The Missing Link in DeFi: On-Chain Data Utilization Empowered by ZK Coprocessors by Wanli Zhou, Head of Ecosystem @ Brevis

Rollups - the Final Frontier of Scaling by Bo Du, Technical Co-Founder @ Polymer Labs

📅 Sept 17th

🔁 Restaking & Infra Day (co-organised by Nubit)

For liquid Restaking and staking, Oracles and other AVSs, and security and risks of Restaking fans.

We got 3 awesome panel discussion for you:

Restaking: The State of Play, Major Results, Downsides, and Future Prospects with speakers from Nubit, Picasso, Karak, Starkware, and Zeebu

The Future of LRTs and Their Impact on DeFi by Eigen, ether.fi, Exocore, Yala, and Renzo

Future-Proofing DeFi: AVS, Infrastructure, and Beyond with speakers from Eigen, Risk Layer, Affine, Bitcoin OS, and Mind Network

📅 Sept 18th

🥮 BTC Scaling Day (co-organised by Nubit)

If you fancy wBTC and alternative interoperability solutions, BTCfi and Restaking on BTC, future developments and perspectives of BTC.

Can't spill the beans on all the speakers yet, but there going be someone from Nubit, GOAT Network, Merlin, Cycle, BOS & Mezo.

Expect lots of insightful networking in our specially designed area! You can really make some valuable connections there.

📅 Sept 19th

🤿 Deep-dive: Solving fragmentation problem with the clearing

How can we solve fragmentation? With clearing it all up!

No, seriously. Everclear proposes new solution to fragmentation - clearing layer.

Arjun Bhuptani, Founder & CEO @ Everclear, will take it from here. Watch full presentation here.

Problem with the fragmentation in modular eco

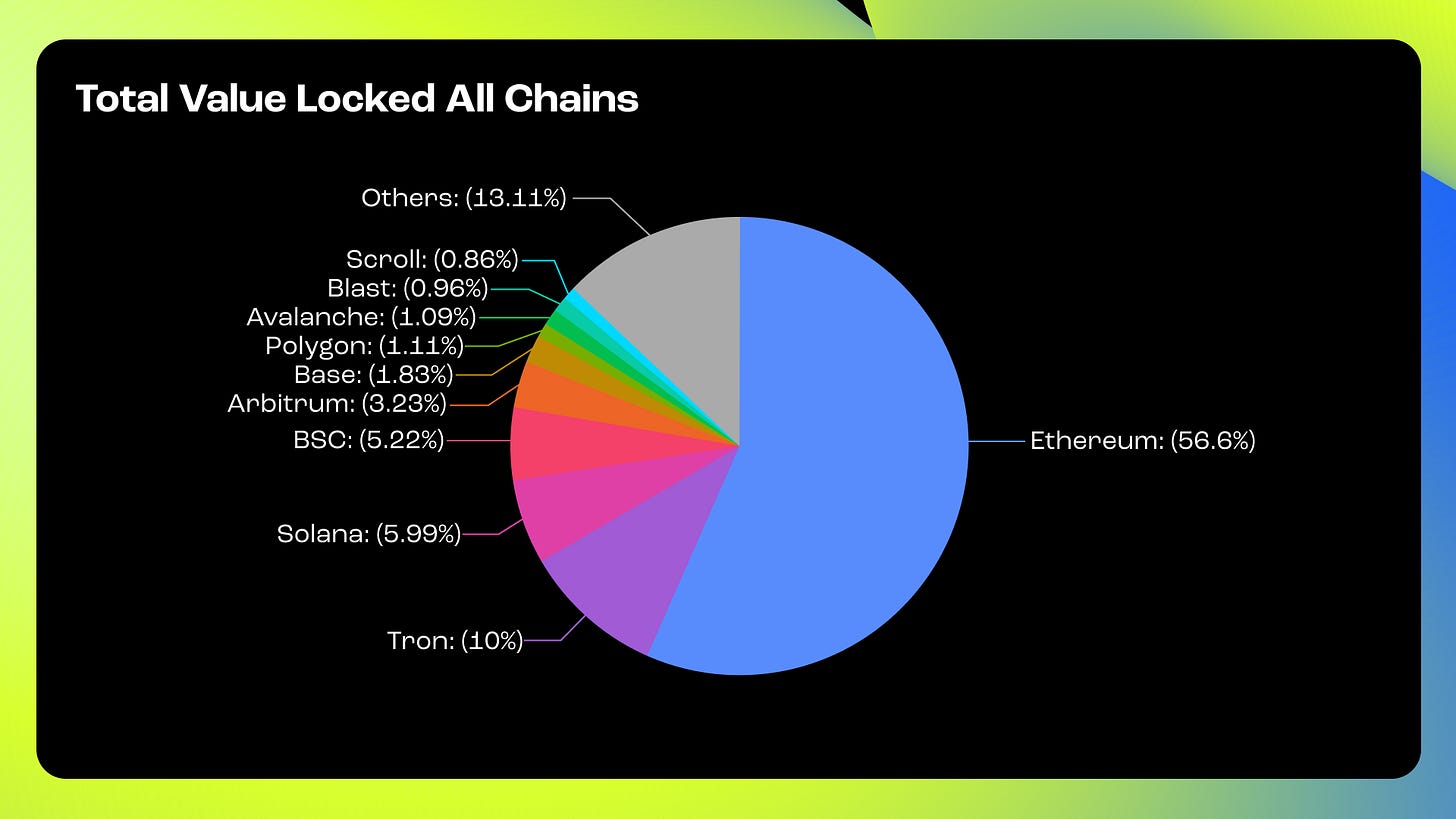

Navigating apps across multiple chains is awful and increasingly impractical. The problem is growing: 61 layer two projects are live, with 79 more in the pipeline, according to L2Beat. That's a lot of roll-ups, and that doesn't even count app-specific or unannounced ones. We're looking at thousands of roll-ups eventually. Roll-ups are the new servers.

So how do we tackle this?

Chain Abstraction to the rescue

It's a vision where a user shouldn't care what chain they're on.

Chain abstraction is an outcome that many projects are working towards together. Near, for example, is developing chain signatures that will allow you to sign and initiate transactions from any chain. Projects like Particle and Socket aim to unify balances across chains, while Across and others are working on bridging and moving funds between chains.

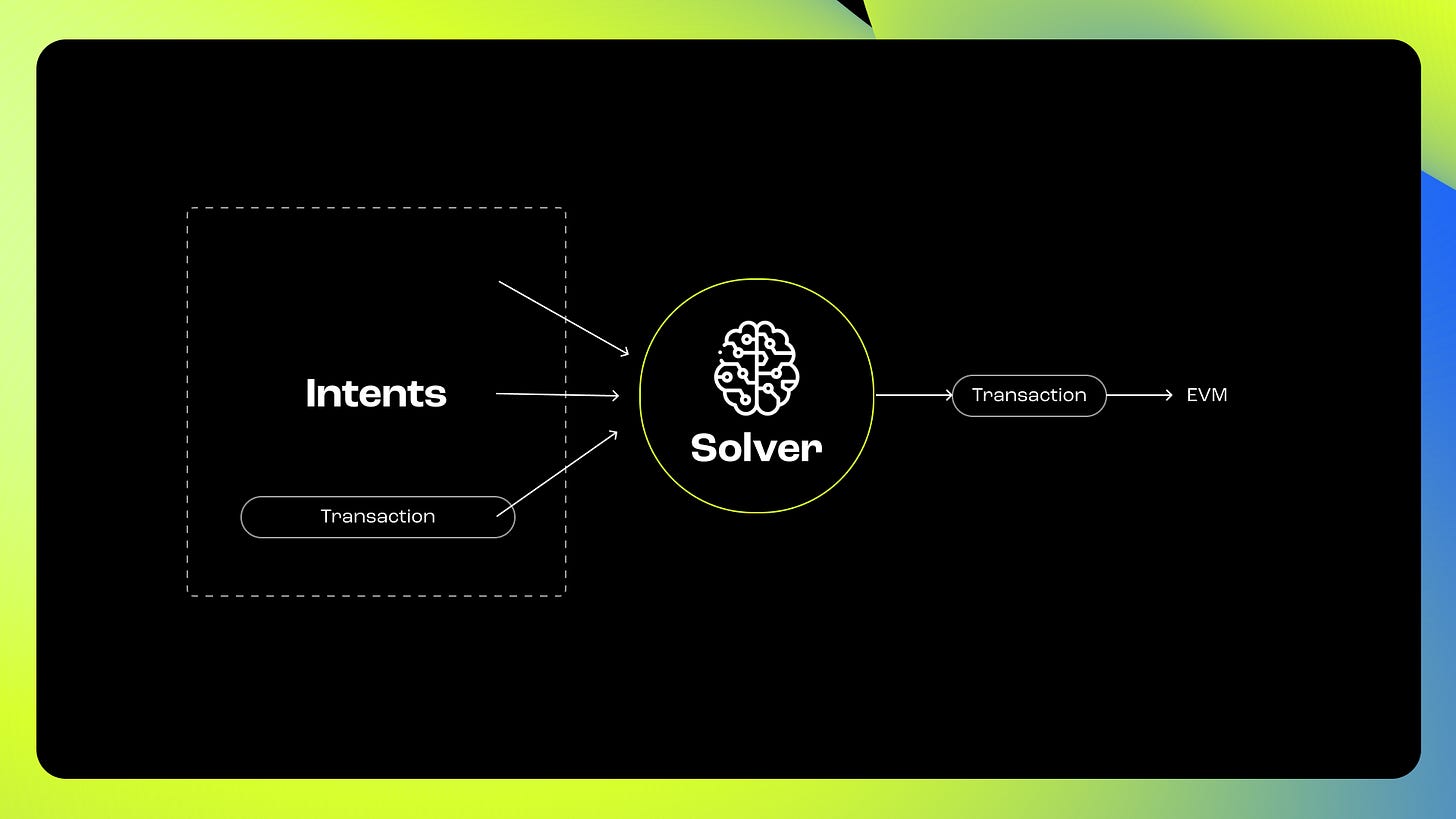

So the whole ecosystem is evolving around this concept of intents.

What are intents?

Intent can be confusing, so let's break it down with an example we all know: Uber. Uber is an intent protocol. You want to get from point A to point B, so you open the app and specify your destination. Uber assumes you want to get there quickly and cheaply, then finds a driver - a solver - to fulfil your request. The driver takes you, you pay, and it all makes sense. That's how marketplaces work, and it's the same concept we want to apply across chains.

Any cross-chain action can be handled by a service provider with gas and liquidity on the destination chain. For example, if you have $100 on Arbitrum and want to deposit into Aave on Optimism, instead of manually bridging funds, switching chains and getting gas, a solver can do it all for you. The transaction looks seamless from your end, and they settle the funds later.

This creates an interesting dynamic because today a few players are handling most of these transactions on protocols such as Across and DLN.

Solver centralization

Solvers are highly centralised, and for good reason. Running solvers requires a sophistication that most people lack - you need to be a market participant who understands both the technology and how to move liquidity across chains. This is the hidden truth of chain abstraction: while it aims to hide the complexity of chains from users, it simply shifts that complexity to solvers, which are mainly sophisticated players.

A look at volume versus transaction graphs shows that giants like Wintermute dominate with huge liquidity, while regular players can barely participate. This isn't decentralisation, it's TradFi in disguise. Ideally, we want a more level playing field, but getting there means understanding the dynamics of solvers. Solvers advance their capital to fulfil your cross-chain trades, but they have to settle and get repaid afterwards - a step that is often overlooked.

The real challenge lies in rebalancing: solvers need to move funds from obscure chains, such as a long-tail L3, back into usable positions. This rebalancing typically involves bridging, relying on market makers, who in turn rely on centralised exchanges. These exchanges often handle this manually, taking on risks such as long lock-up periods due to system fragmentation - moving tokens between chains takes time, especially when security is a priority.

Interestingly, 80% of cross-chain fund movements are net. For example, if you send $1 into the BNB chain, 85 cents will come out in the same time period. So why send the full dollar? The problem is that no one knows exactly what is netted out, leading to inefficiencies.

That's where netting comes in.

How netting can help with that?

Netting is the process of consolidating financial obligations into a smaller, more efficient transaction. For example, $420 of cyclical payments may actually be reduced to just $10 of final movement. So why process $420 worth of transactions when you only need to move $10? That's the power of netting. It's a fundamental part of all financial systems - Visa uses netting to achieve capital efficiency, and the New York Stock Exchange uses netting before settling trades at the end of the day.

Despite its importance in mature financial infrastructures, netting is missing from the crypto space because all players are competing in a PvP game. To fill this gap, Everclear is introducing an entirely new primitive - clearing.

What is clearing layer?

Clearing layers are a mechanism that allows different parties in the ecosystem to coordinate to net out flows of funds. Instead of constantly rebalancing funds across chains like Polygon and Arbitrum, clearing layers help find coincidences of demand, essentially allowing us to do nothing and save costs. Netting is free, and that's the game changer.

How does it work? Think of it as your own rollup, or state container, where everyone declares their fund movements. The rollup finds matching needs between participants using strategies like a modular Dutch auction, similar to those used in Gnosis. Importantly, it's a zero TVL system - not a liquidity pool or bridge - but a co-ordination tool for existing bridges and pools to net obligations.

Historically, the solution to fragmentation has been to build a better bridge with more liquidity, but each new bridge just adds to the problem.

The goal of Everclear, a clearing layer, is to change this by allowing cross-chain protocols to work together for a globally optimal outcome. Everclear sits at the foundation of the new chain abstraction stack, coordinating settlements between intent solvers, market makers and exchanges that need to move funds across chains efficiently. It works with the underlying settlements, including chains, transport protocols such as LayerZero and Hyperlane, and canonical bridges, aligning everyone towards a provably optimal way to move funds.

⚡Blitz News

Cardano and Hedera Join Forces in Web3 Security Initiative

Gate Ventures Invests in Japan’s Largest Web3 Gaming Pioneer

Hypernative secures $16m in Series A to enhance Web3 security solutions

Magic Square Partners with Exodus to Enhance Web3 Crypto Experience

Share this newsletter and earn rewards

Click below, share this newsletter with your friends and earn cool rewards!

All right, that’s it for today! 👋 But wait…

You didn’t say “gm” on Twitter! Let’s catch up there for daily insights.

Sending growth your way,

Epic Web3