🧞Top challenges in Liquid Restaking and plans for EthCC!

Launching our Hackathon & Hacker house

GM and happy Monday frens🖖

This week there was a huge scandal with the EIGEN token announcement and it's airdrops details: about 50% went to the team and investors, some countries were banned from claiming and right now tokens are locked.

So today we want to talk about restaking challenges. But first, something entirely different:

🤝 Two (!!!) Epic Web3 events in July

🗿 Problems with the liquid restaking

📰 This week's news

Join the biggest L2 event in Europe

Join the biggest conference dedicated to ETH Layer 2 Scaling solutions, Infra, Modularity, Data Availability, and more.

Partners such as Cartesi, Starknet, zkSync, Zircuit, Veridise, nil Foundation, and Linea have already joined!

⭐What to expect:

55+ speakers

700+ attendees

Developer focused

🗓July 9

📍Brussels

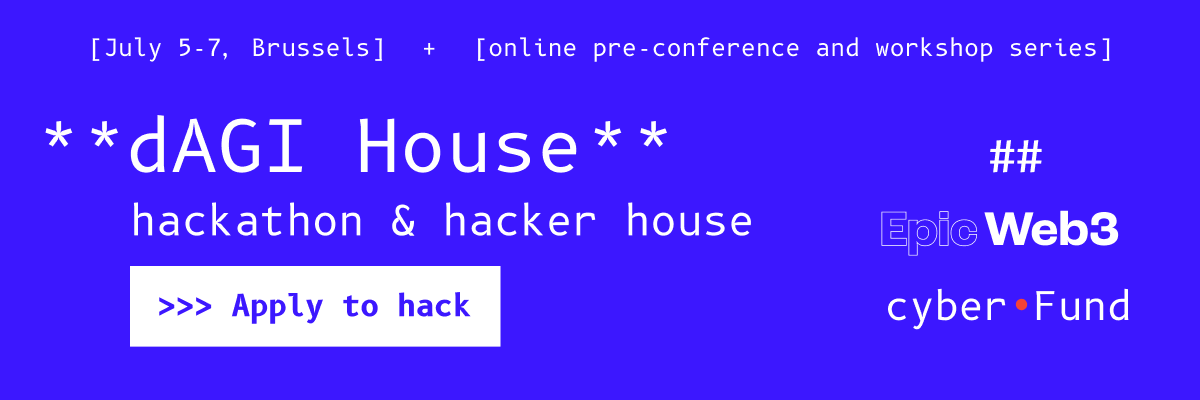

🚨Launching our Hackathon & Hacker house

Explore the design space for AI applications, agents, and protocols to ensure that it will be equally accessible to everyone, unbiased, and personalized.

Spend three days discussing, brainstorming and building decentralized AI with other engineers, founders and researchers. And, of course, win great prizes.

🗓 July 5-7

📍 Brussels + online pre-conference and workshop series in June!

🤿Deep-dive: main challenges with liquid restaking

Insights from talk "Earn Restaking Rewards & Participate in DeFi " by Amitej Gajjala (Co-Founder @ Kelp DAO). Full version is here.

Complexity in Selection

It is very complex for an average user to select a particular operator and also the service that they want to restake their assets with. Why is it complex because you will have like dozens of operators providing validation services on the network and also you will have like 10s or maybe 20, 30, 40 services that are seeking economic security.

Decision-Making Difficulty

For an average user decision making around which AVS to select or which operator to select is going to be extremely complex, they will have to do a risk management across these spectrum of choices and it is very hard for them.

Complex User Experience

The second big difficulty is it is going to create like very complex user experience because once they restake with multiple protocols that is provide economic security to multiple services or actively validated services, they are going to get rewards in different tokens either governance tokens of those protocols or stable coins or Ethereum or they have to claim each of these tokens individually that means high gas fees on Ethereum mainnet which is going to be like very, very expensive for an average user.

Liquidity Constraints

The gas fees component is covered and then they are going to have like liquidity constraints. Now protocols like Eigen layer impose a 7 day withdrawal window or unstaking period during which users lose liquidity and once they restake their ETH or LSTs on these protocols like Eigen, they cannot use those assets in DeFi again.

⚡Blitz News

📚Web3 Publishing Platform Mirror Sells to Paragraph, Pivots to Social App 'Kiosk'

👨🏻💻Web3 Lost Over $53 Million to Hackers in April 2024, $401 Million YTD – Immunefi

🍷Web3 wine marketplace Baxus raises $5m from Multicoin Capital, Solana Ventures

🕹️Solana Labs teams up with Google Cloud on Web3 games via GameShift

All right, that’s it for today! 👋 But wait…

You didn’t say “gm” on Twitter! Let’s catch up there for daily insights.

Sending growth your way,

Epic Web3