Gm and happy Monday frens🖖

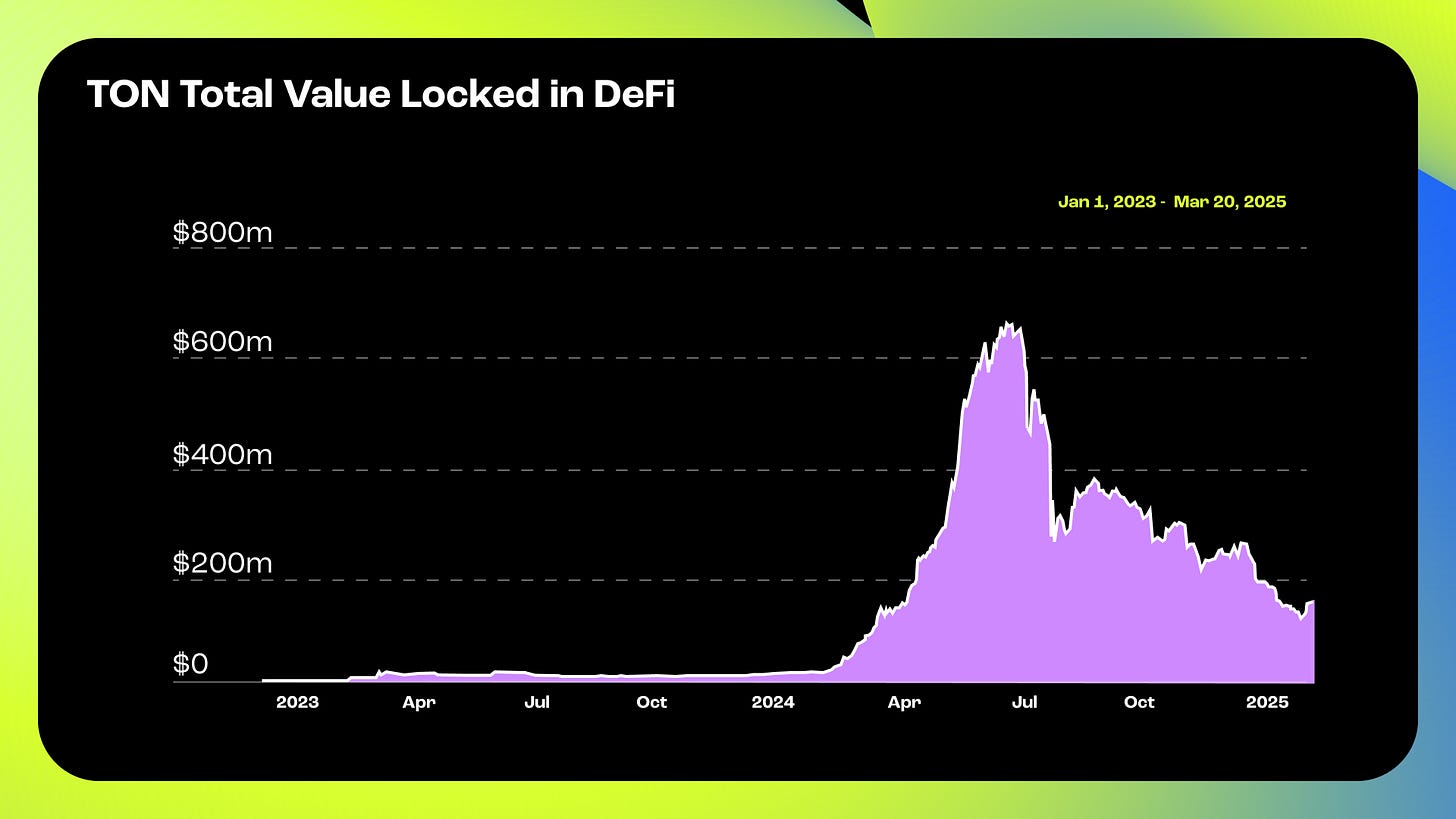

TON TVL is down from 770M$ in July to just 173M$ now.

Should we be planning a funeral?

Not yet. Here are the insights of one of TON's biggest DEXs on why the ecosystem still has a future.

Scroll down to see:

🗣️ Your plans for Token2049

🏋 TON - be bullish or be bearish?

🧵 Wallet drainers & LIL

📰 Neeews

🧞♂️Epic Web3 x4 → Token2049

We're dropping not one, not two, but FOUR side events at Token2049!

Each focused on a key narrative that's reshaping the industry right now – from modular infrastructure and mini-apps to restaking primitives and autonomous agents 👇

Transforming the Web3 future with scalable L0s, rollups, cross-chain solutions, modular app-chains, chain abstraction, and seamless user onboarding.

Mass adoption blueprint: viral growth, secure mini-apps, smart fundraising, cross-platform expansion, and strategic partnerships.

Day Cross-chain dialogue on restaking and DeFAI: liquid restaking, AI-driven markets, AVSs, multi-chain strategies, and security risks.

The future of autonomous Web3: sustainable agent economies, investment in decentralized intelligence, navigating regulations, leveraging quality data, and deploying multi-agent systems.

🛠️ Deep-dive: The Future of TON

Will TON bring mass adoption? Are there any serious traders in Telegram? What are the best ways to onboard active users?

All that in our new episode with Lev Vladykin, Head of Partnerships @ Tradoor, the fastest DEX on TON! Check out the full episode here.

Telegram as a super app

Telegram aims to become a crypto-focused super app, similar to WeChat. Real-world applications are emerging, such as crypto taxi payments within Telegram, though mass adoption is still a work in progress. The integration of banks and QR code payments may expand its role beyond crypto, but currently, most mini-apps remain crypto-centric.

One challenge is that few Web2 projects are building on Telegram, possibly because Telegram is reserving itself for TON. While some apps attempt to bridge crypto with real-world services, like QR payments and banking integration, the platform still has a long way to go before achieving the same level of functionality as WeChat.

State of the TON ecosystem

TON’s TVL has dropped, similar to other blockchains like Solana, as part of a broader market cycle. However, interoperability efforts are underway to bring assets from EVM and Solana into TON.

According to discussions with the TON team, 2025 is expected to be the "Year of TVL" for TON, with more liquidity protocols, bridges, and staking mechanisms launching. Trador is collaborating with Liquid Staking Protocols from Solana to bring TVL onto TON, alongside liquidity pools and cross-chain integrations.

Despite current liquidity challenges, there is strong developer activity, and the ecosystem is shifting focus toward cross-chain compatibility to attract more capital and users.

Does Telegram help with crypto adoption?

Telegram significantly lowers entry barriers for crypto users by providing one-click access to trading apps, wallets, and crypto purchases. However, most whales and professional traders still prefer Web apps due to the limitations of Telegram’s interface.

Many Telegram users engage in degen-style trading, making small trades without deep market analysis, partly due to the simplified UI and mobile-first experience. More advanced traders require sophisticated charting, strategy tools, and trading frameworks, which are difficult to implement in a mini-app format.

Despite these limitations, Telegram’s ease of use means it is an effective gateway for onboarding new crypto users, while more serious traders eventually migrate to Web-based platforms.

Challenges & advantages of building on Telegram

Building a trading app on Telegram comes with unique challenges, including:

User education – Many Telegram mini-app users are unfamiliar with crypto and DeFi, requiring simplified interfaces and built-in tutorials.

Limited screen space – The mobile-first approach makes it hard to implement complex charting tools and strategy frameworks.

Regulatory concerns – Some regions (e.g., China) ban Telegram, requiring VPNs for access and limiting market reach.

Lack of institutional-grade tools – Whales and professional traders need more sophisticated tools than what a Telegram mini-app can currently offer.

Due to these challenges, having a Web application alongside the Telegram app is essential for long-term growth and professional adoption.

Being one of the only PerpDEXs on TON gives Trador a strong first-mover advantage. However, liquidity is still growing, and projects like LayerZero and TAC are helping bridge assets from EVM chains to TON.

While TON’s exclusivity to Telegram limits competition, it also restricts access to broader DeFi liquidity pools. Cross-chain integration is expected to enhance liquidity, allowing TON-based projects to tap into other blockchain ecosystems.

Despite these trade-offs, Trador believes that TON's positioning within Telegram makes it an ideal platform for mass adoption, especially once DeFi infrastructure matures.

Learn more about TON Ecosystem with our new podcast!

🧵 What you might missed on Twitter

Get the best alpha from Web3 Twitter, without scrolling aimlessly for hours.

Just click on the tweet to read a full version!

POV: Your wallet is drained

First-person story about losing your money because of a wallet drain.

New word: Liquidity Integration Layer

Will it change anything?

New projects on TON

Overview for interested folks

⚡ Blitz News

ClearFake exploits Web3 capabilities for malware campaign

US Web3 wallet firm Privy nets $15m funding round

Web3 AI Startup Pluralis Bags $7.6M Pre-Seed and Seed Rounds to Take On OpenAI

Dubai Launches Pilot Phase of Real Estate Tokenisation Project for Web3, Real Estate Collaboration

All right, that’s it for today! 👋 But wait…

You didn’t say “gm” on Twitter! Let’s catch up there for daily insights.

Sending growth your way,

Epic Web3